Luxury Monkeys

Why the business of selling dreams and exclusivity is so huge. NFTs = digital luxury goods.

A few weeks back, while strolling through the corridors of Marina Bay Sands, my girlfriend casually dropped a fascinating nugget of financial wisdom that instantly piqued my interest:

"Did you know," she mused, "Chanel bags are not just a fashion statement. They're a great investment. Their value increases by 10% every year."

That casual remark set my mind whirling. A mere leather handbag outpacing the S&P500 in returns? I looked it up, and she was right.

What's the secret sauce here? Is it “utility”, or does the magic lie in scarcity? This led me on an eye-opening journey into the business of luxury brands. And here's the kicker:

Luxury brands are incredibly high-margin businesses, surpassing tech and software.

The landscape today

I mapped out the landscape of a few of the world’s top luxury brands.

There are two distinct realms in high-end luxury: the brand conglomerates and the enigmatic family-owned businesses. Let's delve into this, shall we?

First up, the conglomerates — dominated by the holy empires of LVMH, Richemont, and Kering:

LVMH, a French behemoth, consists of about 60 subsidiaries managing 75 luxury brands, from Louis Vuitton to Dior. LVMH has grown to this scale through a mix of incredible strategic acquisitions by its chairman (and richest man in the world) Bernard Arnault. I highly recommend listening to this episode of Acquired for the LVMH story, it helped with a lot of my research on this post.

Kering, a global luxury group established in 1962 by François Pinault, has evolved greatly from its beginnings as a timber trading company. Kering transitioned into luxury by acquiring a controlling stake in Gucci Group and Yves Saint Laurent. Today, its portfolio also includes renowned brands like Bottega Veneta and Balenciaga

Richemont is the Swiss luxury powerhouse with brands like Cartier and Van Cleef & Arpels under its wing. It operates with an autonomy that ensures the unique essence of its brands remains untainted by the overarching corporate identity

Brand conglomerates are particularly interesting because they can leverage economies of scale — very rare in an industry that prides itself on craftsmanship and exclusivity.

Even though design and production remain specific to each brand under its umbrella, LVMH achieves economies of scale in procuring raw materials, marketing, and securing advertising deals.

They’ve perfected this art, creating a 'machine' that not only elevates brands that come under its umbrella but also doubles their value, operating on gross margins of around 30%. and a hands-off approach that lets each brand retain its unique charm.

Now, contrast this with family-owned luxury brands like Hermès, Versace and Prada.

Here, heritage and tradition are the names of the game. These brands are bastions of craftsmanship and exclusivity, preserving the legacy and values of the founding family. They are often resistant to rapid expansion and fiercely protective of their brand identity. It's a more conservative approach that has cultivated a fiercely loyal customer base and a perception of unparalleled exclusivity.

What is luxury in the first place?

Coco Chanel defined luxury as “a necessity that begins where necessity ends”

In other words, luxury transcends value and direct utility. Luxury brands sell dreams, aspirations, and an exclusive lifestyle. It's about the prestige, the status – it's about owning something that is as much a flex as it is a fashion statement.

Contrast this with standard and premium goods, where prices are ultimately determined by utility.

Designer Handbags are the pinnacle of luxury goods.

The rise of automobiles and the increasing acceptance of women in the workforce in the 20th century diminished the need for traditional fashion items like hats and gloves. I mean, hats aren’t exactly car-friendly attire.

Handbags remained one of the few women’s fashion items that persisted and flourished, transitioning from practical items to symbols of fashion and status.

And handbags are a masterclass in the high-margin business.

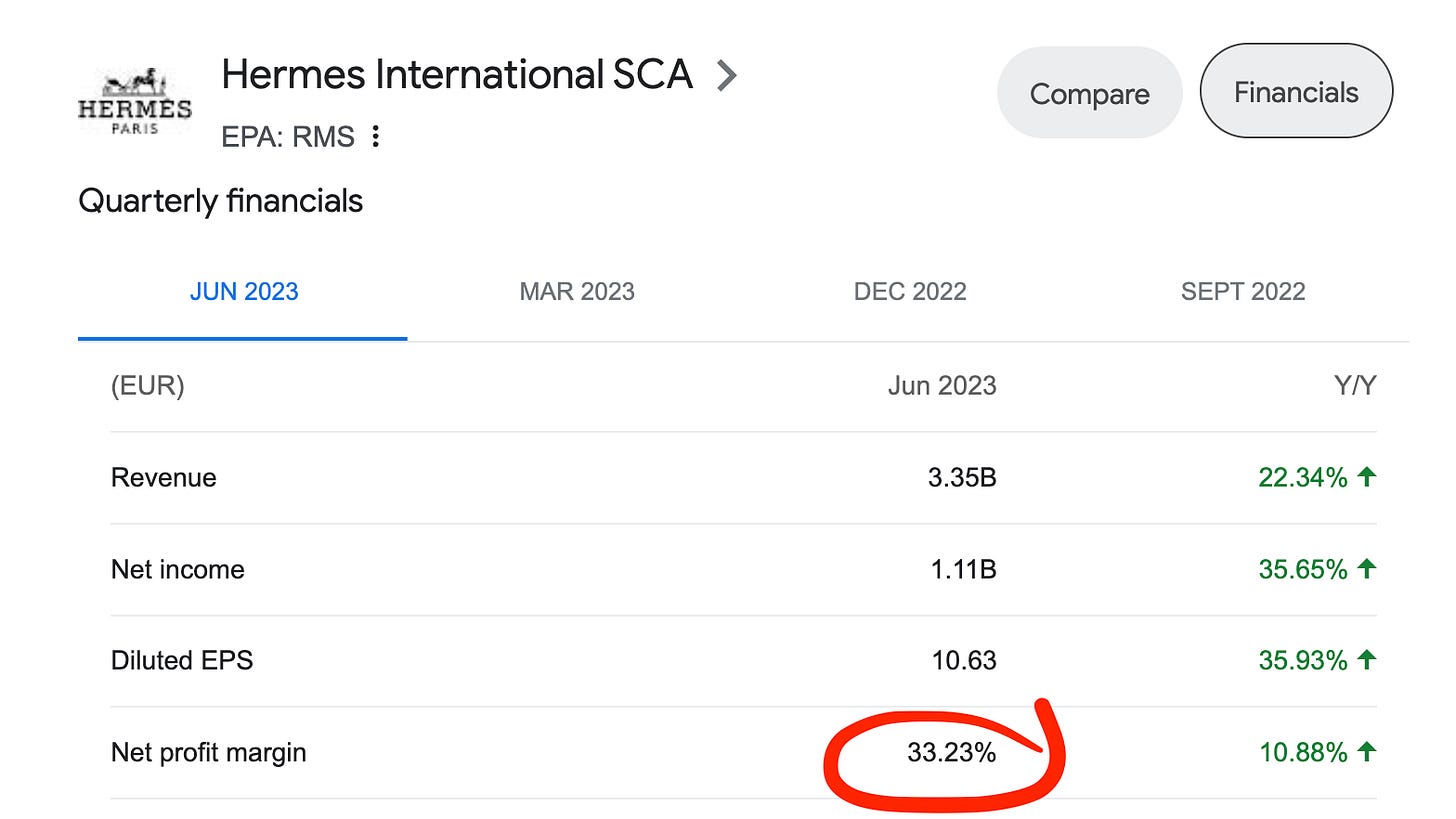

Take Hermès, for instance. As of June 2023, it boasts a company-wide net profit margin of 33%. This is on par with FAANG darling Meta, and 1.5X greater than Netflix. We're talking software-level profitability, light-years ahead of typical consumer goods margins. For comparison, Nike hovers around an 11% net profit margin.

Here's where it gets really interesting – at the product level. Considering the abundant availability of leather and the hefty five-figure price tags on each Hermès handbag, the margins could soar to an astounding 80 - 90% relative to production costs.

Did you know that the average American woman owns 6 to 11 handbags (various sources) and buys 2 to 3 handbags annually?

Two words come to mind: Recurring revenue.

The Big Idea

The transition from traditional opulence to digital exclusivity will be a natural evolution in luxury.

If Birkin bags = peak physical luxury goods,

Then CryptoPunks NFT = peak digital luxury goods?

Why else would a CryptoPunk NFT be worth $100,000+ each, or a Fidenza sell for $250,000? These digital assets, much like their physical counterparts, offer limited real-world utility but command a strong market demand — a hallmark of luxury goods.

These empires, historically masters of the physical luxury goods market, are now venturing into the digital domain, particularly attracted to the high-margin potential of NFTs.

LVMH launched its Via trunks NFTs, which cost $39,000 each and inclusive of a physical trunk. It’s also a key player in the Aura consortium that is using the blockchain for authenticity and customer engagement. LVMH has been dabbling with NFTs since 2021.

In the Web3 space, we often muse about who will be the next Disney. Ambitious teams sell the story that they will be the one. But I’m more interested in who will be the LVMH equivalent in Web3: owning the luxury, super high-margin vertical.

For the “LVMH of Web3”, there are several areas I believe are ripe for exploration:

1. Dynamic NFTs: Not just monkey JPEGs

Moving beyond static digital images of the past, the future of NFTs lies in dynamic, interactive experiences.

Example:

ERC-6551 (or Token Bound Accounts) is a new standard that allows every NFT to possess its own personal wallet. NFTs can now do anything on-chain — take ownership of assets, execute on-chain actions, and interact with other apps. This opens up limitless possibilities for novel digital consumer experiences.

2. Loyalty Programs: But make it exciting

We all know the old-school loyalty punch cards, tucked away in our wallets, forgotten. Or online shopping with meaningless points. But what if loyalty programs became something you actually eagerly anticipate?

Web3 and NFTs are breathing new life into this concept. Think beyond the ordinary – exclusive access, special offers, and an open world where different loyalty programs play nice with each other. The blockchain's inherent interoperability facilitates collaborations and expands consumer benefits.

Examples:

Loyalty+ is an open interconnected rewards ecosystem, powered by smart tokens.

TYB is a “play-to-earn” platform for brands to cultivate meaningful connections with customers.

3. Fashion that talks back

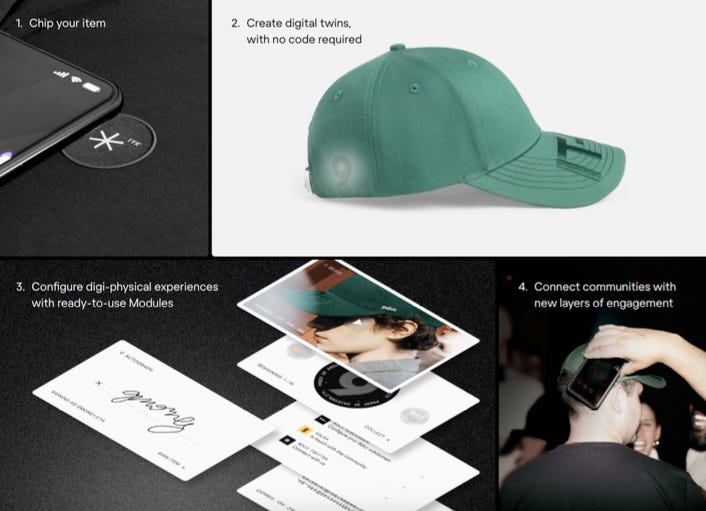

Technology is transforming traditional apparel into interactive experiences.

Examples:

IYK. By embedding special NFC chips into garments, IYK enables clothing to become more than just fabric; these items become platforms for unique digi-physical experiences.

Using IYK, 9dcc has released a line of luxury T-shirts as a “networked product”. Wear it, let your friends scan the NFC chip on the T-shirt, and watch it weave connections based on your real-world interactions. Fashion items can now have connection and utility.

4. Wear-to-Earn

Imagine getting rewards for simply wearing and sharing your favorite brands. Flaunting your style on social media earns you tokens. That's 'Wear-to-Earn'.

It's a win-win – brands get genuine engagement, and consumers get rewards for showing off their style. This could be a much better use of marketing spend for brands than digital advertising, which is a crowded space and often late to the customer’s intent to purchase.

Example:

BNV is pioneering this model, exploring new marketing strategies in the digital space.

In conclusion, the most attractive businesses in the world today are in tech and luxury.

Imagine the electrifying possibilities ahead if you combined them both.

Thanks for reading,

Teng Yan

This post represents my personal views only and not those of any organization I’m affiliated with. The title was inspired by Patrick McCormick’s “Status Monkeys”, a great read on NFTs and social networks.