Market Musings #3: The Road to $5,000+ ETH

I'm bullish, and here's why.

This month, the crypto markets have taken a wild ride downhill. Many investors are spooked, and their portfolios have been de-risked faster than you can say “HODL.” Fear is high, and sentiment is at rock bottom.

BTC broke under $54,000, and ETH fell below $2,850 last week.

Exactly why it’s the right time to steelman the bull case for ETH.

Before we dive in, a quick shoutout: I’ve been super active with my writings on AI over at Chain of Thought, a free weekly newsletter covering the top projects in the space.

Click here to subscribe so you’ll never miss the most important trends in Crypto x AI.

Near-term Catalysts

Spot ETH ETFs are anticipated to launch around July 15, less than a week from now. Given the heavy sell-off we’ve seen in advance, it’s reasonable to expect a relief rally on this news. Initial spot ETF flows are anyone’s guess, but I believe they will exceed expectations over a 12-month period.

In my opinion, the most convincing argument for better inflows is that TradFi investors already allocated to the BTC ETF will diversify by buying ETH as well. This move allows them to capture a broader segment of the crypto market (digital gold + tech platform) while reducing perceived single-asset risk. “Diversification” is a word that many investors love.

ETHE outflows might be limited. Right now, it’s trading at NAV, so investors wanting to exit can already do so without waiting for the ETF launch. Additionally, Grayscale announced it would distribute shares of its new Ethereum mini trust, which has lower fees, to existing ETHE holders on July 18.

Crypto markets, including ETH, are being dragged down by the German government selling BTC and Mt. Gox distributions. While some of these fears are justified with actual outflows, this issue is idiosyncratic and should be resolved sooner rather than later. Germany, in particular, has been blitzkrieging the markets, with <$1B of BTC left to sell, down from $3B last month.

Current Market Positioning

ETH perpetual futures open interest (OI) is back to pre-ETH levels. While this might not be highly significant due to overall changes in positioning, it indicates a general lack of interest or attention, leaving more potential upside.

ETH sentiment is at its lowest despite the imminent ETF launch. This gives a sense of market positioning

Many sidelined investors and traders (e.g. Jason Choi/Tangent, Andrew Kang/Mechanism) have laid out their thesis on why we’re at a bear market inflection point. This could be true, but no one knows for sure. If prices start rising convincingly, they will have to buy back in.

Mid-term Outlook

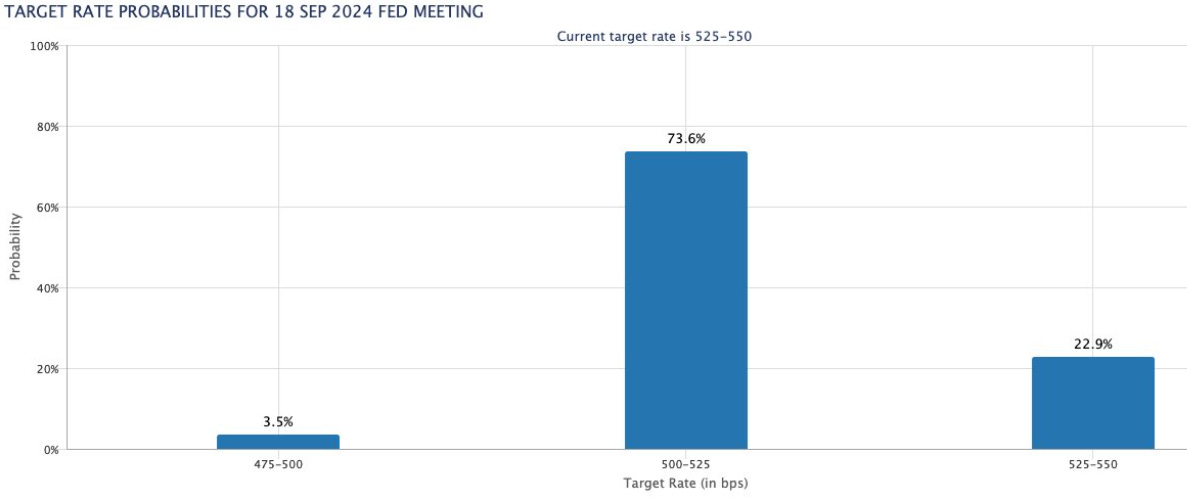

An improving macro environment is also on the horizon. We’re starting the rate cut cycle, with markets pricing in a 73% chance of a rate cut in September. Citi analysts predict that interest rates could be slashed by 200 basis points through 2025. We seem to be on track for a soft landing.

FTX creditors are expected to get back $14-16 billion in cold, hard cash towards the year-end. These are crypto-native folks, so it’s reasonable to think they might use some of it to buy crypto (h/t @wintermute_t).

There’s also a good chance of Trump winning the election, which could mean a better regulatory outlook for crypto. And goodbye to Gensler as SEC chairman.

I’m Long on ETH

There are solid reasons to be bullish about ETH in the near to mid-term.

And I’m not alone in this thinking:

I haven’t even touched on the technology here — let’s assume we agree that Ethereum is a vital component in the potential success or failure of crypto as an industry. The underlying assumption is that ETH is the best technological bet on a tokenized world.

“If you want to invest in the growth of tokenisation, Ethereum is the picks & shovels play. It underpins all of it.” - Matt Hougan, CIO at Bitwise

One thing’s for sure: it won’t be a straight road up.

Markets are still on edge and need to regain confidence after last week’s shakeout. With the summer holidays, big capital may not be ready to buy until August.

Cheers,

Teng Yan

Disclaimer: This is intended solely for educational purposes and does not constitute financial advice. It is not an endorsement to buy or sell assets or make financial decisions. Always conduct your own research and exercise caution when making investment choices.