Right-Click Save #2: Culture is a meme. So are NFTs.

NFTs are the bridge between culture and monetary value. As digital, material representations of a set of values and beliefs, they can drive powerful cultural narratives.

Appraising NFTs sounds a like simple task but it is in fact one of the most challenging things to do - it encompasses many intangible aspects like culture and aesthetics. Doing this well requires a combination of deep vertical knowledge, experience and a keen intuition. I personally believe that NFT appraisal is going to be a powerful new job in the future metaverse (where everything is a NFT). They will be the digital counterparts to the real-estate appraisers or art appraisers of today. I admire teams like Upshot who have dedicated their time to solve the pricing problem with unique approaches, even though my view is that a purely data-driven approach is insufficient.

We know all valuation metrics are a meme. Monetary value is not physics: and so it cannot be quantified with certainty in a truly objective way, unlike the temperature of the air today (32 degrees celsius, it’s sweltering hot in Singapore) or the speed of the car. As humans, we ascribe value to things we perceive as important, or that we believe others perceive as important. If enough people believe it, it becomes real.

Think about it:

Bitcoin Stock-to-Flow? Meme

Stocks P/E ratio? Meme

Gold? Meme

Interestingly, memes are also the means by which we propagate culture. NFTs represent digital culture. Pushing along that line of reasoning, I believe that NFTs are the bridge between culture and monetary value.

Culture is the most important thing to understand when thinking about NFTs. We as a community determine what is culturally valuable and what is not, voting with our Metamasks and 24/7 twitter shills. But what is culture? I’m not a sociologist, so in a very simplistic way:

Culture is broad and encompasses the shared experiences, perceptions and beliefs of a society. Culture is powerful, because it imbues us with a sense of purpose and collective identity. Some sociologists classify culture into material and non-material culture. Material culture are tangible items that emerges from and is shaped by non-material culture (eg. beliefs and values).

In this way, we can think of NFTs as digital, material representations of a set of values and beliefs, which can drive powerful cultural narratives. Narratives attract people who vibe with it.

Some quick examples of cultural narratives represented by NFTs (in my personal opinion):

CryptoPunks: wealthy intellectual early adopters

XCOPY art: underground, OG crypto culture

Art Blocks Curated: sophisticated contemporary art appreciators

There are 4 major factors in play around culture:

Brand Value

Historical Value

Mimetic Value

Flex Value

These are not the only factors impacting culture. However these are important ones that can drive strong fundamental narratives and are worth reflecting upon in depth.

1. Brand Value

What brand does the NFT represent? Usually, it’s inexorably linked to the creator’s brand - an artist or organisation. So let’s first look at that and draw our conclusions.

The cultural value of a work by a renowned artist (eg. Damien Hirst, Tyler Hobbs) is far greater than that of a new artist - because the artist brand is conferred upon the artwork. Hence it is natural for their works to be priced much higher.

A great artist’s brand is so powerful that even just being ‘lightly’ associated with the artwork is enough to increase its value tremendously. Damien Hirst is famous for his ‘hands-off approach’ and has a team of studio assistants who paint/produce his actual art works while following his artistic vision. He might add a few dots or his signature at the end. A signed work is considered a ‘Hirst’ and fetches significant multiples over an unsigned one. The equivalent in the web3 world could be that any NFT smart contract created by a ‘Hirst deployer’ in the future would automatically represent his brand and be immediately sought after.

The reflexivity here is that contemporary digital artists that continue to produce great works and infuse the right dose of showmanship will organically grow their personal brands. This in turn leads to a higher cultural value for all their works as a whole and increase demand. Collecting works of a talented growing artist and holding on for a long time as cultural value accrues can be a wonderful investment thesis. Just ask the people who bought and collected XCOPY and Hackatao works from 2017 - they are worth millions today. We’re all searching for the Picasso of the crypto art era, yet this will only come to light retrospectively.

At one end of the spectrum, well-established commercial brands & organisations (eg. Disney, McDonalds, Budweiser) have started dipping their toes into NFTs. This is easier to pontificate on, because the NFTs feed off their existing brands. Disney is fun & dreamy, McDonalds is fast/cheap and these will reflect in their NFTs as well.

On the other side, brand value can start from zero and grow/evolve organically. This is especially common in crypto-native projects. In this case, the emerging brand is very closely tied to the community and what they stand for.

Six months ago, 4 pseudo-anonymous folks started the Bored Ape Yacht Club. Today, it has grown to be the web3 representative for street culture and is already drawing close comparisons to Supreme, a 27-year old billion dollar brand. They have limited-edition merchandise drops for members only, which are highly sought after and proudly worn. In fact, the big news this week is that they just teased a partnership with Adidas.

2. Historical Value

There are 2 components to history, in the context of NFTs:

Timestamp: How long ago was the NFT minted/created?

Today, it is obvious that the market places a premium on NFTs that are older in block age. This is in part due to the Lindy effect, and partly due to scarcity. NFTs from 2017 are considered more valuable because there were so few of them back then. There are NFT ‘archeologists’ (e.g. Adam McBride) who scour thousands of smart contracts from years ago to unearth forgotten projects. Not a bad job to do, at least you don’t get sand in your pants like real archeologists do.

A wonderful example of this is the CryptoArte project, a series of 9,895 generative artworks based on the Ethereum blockchain. It was first minted in 2018 and minted out fully only in 2021. CryptoArte NFTs that were minted in 2018 have a floor price of 3E each today, which is 20x more compared to those that were minted recently in 2021 (0.14E), when adjusted for comparable rarity.

Is the NFT the first of its kind, or represents a historically significant event?

Crypto is a young, hyper-growth sector with just over 10 years of history. We are still in its early days. Many of the things today and in the near future that contribute to the evolution of crypto will be seen as important and scarce historical artefacts 5, 10, 20 years down the road. Similar to museum artefacts, they are sought after by wealthy, sophisticated collectors. Prominent collector Vincent Van Dough aptly puts it when tweeting about one of his purchases:

Example 1:

At risk of irking many collectors, I would say that Autoglyphs look quite basic. If you tell your normie friend that he would have to pay 6 figures to buy this JPEG, he would think you’ve gone mad. Their high value (225E / $1,000,000 at time of writing) comes entirely from the fact that they are regarded as the 1st fully on-chain generative art NFT and so a prized piece for rich collectors of crypto history to own.

Example 2:

Kabosu is the Shiba dog that accidentally became the face of arguably the world’s most famous meme - the story of Doge is pretty fascinating and worth a read on how it come to be. She represents 10 years of meme culture - nonsensical, illogical and hilarious. The original NFT minted by her Japanese owner is now worth hundreds of millions of dollars. It was bought by PleasrDAO and fractionalised as $DOG tokens so that thousands of people can own part of this cultural icon.

3. Mimetic Value

Mimetic desire is a fundamental part of human nature. Our desires do not come intrinsically, it comes from seeing what other people want. This feeds into our own desires. My friends all own Rolexes, so I want a Rolex too. As Arthur Hayes so aptly puts it, the process is reflexive. Once we own something, our insecurities lead us to proclaim to the world how wonderful it is, leading to a self-fulfilling prophesy.

A lot of traditional advertising plays upon this instinct (which we unfortunately cannot turn off) and thus feature celebrities or influencers hawking products. One of the most successful examples is the legendary partnership between Michael Jordan and Nike. Billions of dollars worth of Air Jordans have been sold to MJ fans.

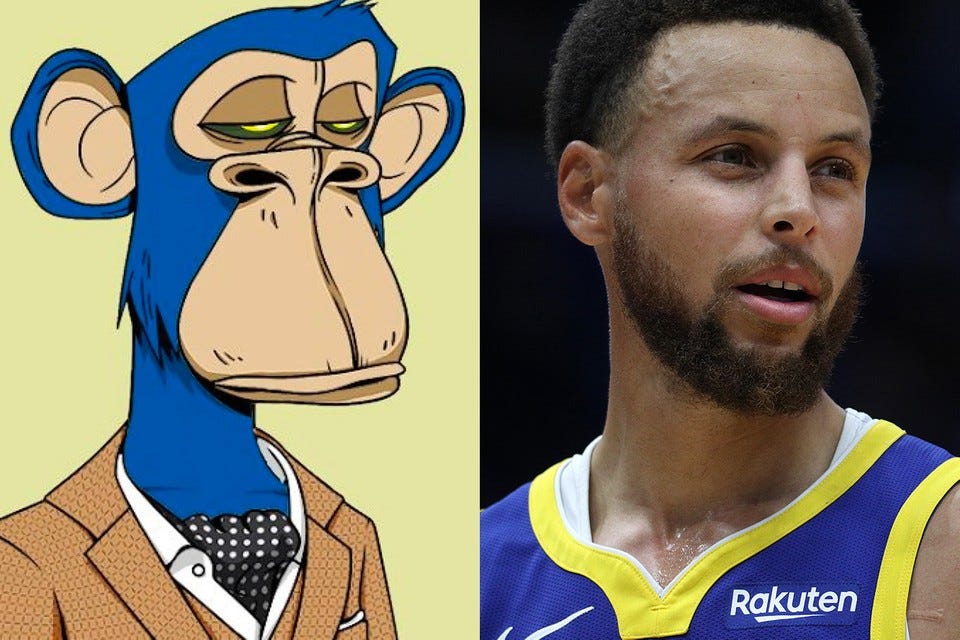

Since early this year, more mainstream celebrities are jumping on the NFT bandwagon and publicly adopting NFTs as their social media profile pics. Rappers seem to gravitate towards CryptoPunks (Jay-Z, Snoop Dogg) while sports stars go for edgier choices (Stephen Curry -> Bored Ape, Shaq -> Creatures). A flurry of NFT sales follow every ‘celeb initiation’, probably from both from speculators and fans.

It is often insightful to look at who the prominent owners of the NFTs are (ENS with human-readable wallet address has made it easier to deduce this) and whether they have a sizeable group of downstream wannabes. Monkey see, Monkey do.

4. Flex Value

I was considering whether to include this under ‘culture’ but I think it deserves a place here.

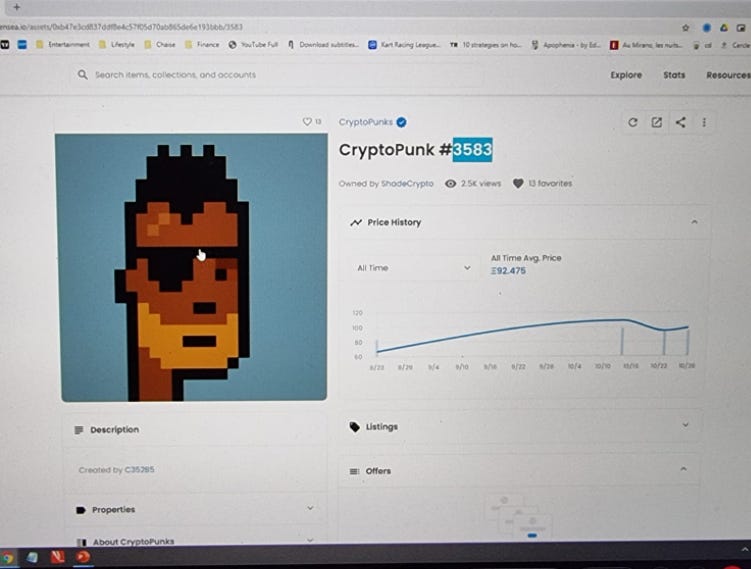

This week a good friend and ex-schoolmate of mine in the banking industry texted me a screenshot of a black eye-patch CryptoPunk #3583, saying: “400k for this.. I dun understand”. I explained to him that this is the new digital flex and that owning one is a sign you have made it. Also, that Chinese billionaires are buying them. He got it immediately.

Flexing is our means of social signalling as human beings - similar to peacocks with their fancy feathers and cats with their mating calls. It is the reason we splurge 50 grand on a Rolex only to squint at the clock face when we could tell the time more easily with a $50 Casio watch. Outside of the metaverse, owning a Rolex is akin to telling the world that you’ve made it (somewhat) and have excess energy and wealth to spare.

Arthur Hayes (again) defines flex goods as :

Intrinsically worthless

Scarce

Confers membership into an exclusive club

NFTs have the potential to be the ultimate flex symbol as we head into a post-pandemic world where we spend a large and growing part of our lives online. If I wear my Rolex everywhere I go for a month, perhaps 100s of people might have the ‘privilege’ to see this work of chronographic art. That’s not very efficient.

Let’s say instead I own a CryptoPunk. I can now flex to 1,000s of people, including faraway friends and long-lost relatives who come across my social profiles but to whom I never talk to directly with. Now I can even flex in my sleep. It’s a socially acceptable, non-obnoxious way of showing how wealthy I am, that I can afford to throw half a million dollars on a pixelated image (comes up to approx $1,000 per pixel). It’s an even better flex because anyone can check the prices of punks online and know how much they’re worth immediately, whereas its much more difficult to find the price of a particular Rolex.

Today, CryptoPunks, Bored Apes and Fidenzas have some of the highest flex values in the NFT world. Owners are signalling that their net worth is at least 7-8 figures, depending on how many they own. It often goes beyond wealth too - with Fidenzas, you’re also flexing good taste and appreciation in the arts.

Putting it all together

Cultural narratives are very powerful. I’ve presented one way to think about culture in more tangibly, so we can better identify NFTs with high or growing cultural value.

Simplistically:

Cultural value = Brand value + Historical significance + Mimetic Desire + Flex value (+ others)

But remember, at the end of the day all valuation is just a meme.

Summary pointers for the astute investor/collector/creator to consider

Proxies for Brand value

Number and quality of twitter followers for the main brand account

Affirmation from experts and elites in the space (e.g. Twitter mentions)

Strength of the pre-existing brand (if mainstream brand)

Sum of brand partnerships

News mentions

Google Trends: interest over time

Proxies for Historical value

Length of existence since the mint date

Is this a first of its kind or tied to a significant event/milestone?

Proxies for Mimetic value

How many celebrities/influencers are active owners of the NFT? What is their estimated reach?

Do we anticipate other celebrities to buy these in the near future?

Number of unique owners (the more ‘real’ people, the greater the reach of mimetic desire)

Proxies for Flex value

Is the item scarce?

Does holding the item give me access to an exclusive community?

Is the item otherwise useless? (like Ether rocks)

One final note: there’s been a lot of debate about whether it is ethical to right-click save NFTs. Some people question how NFTs can hold value if they are so easy to ‘steal’ and that we should prevent this. My view is that this is in fact good for NFTs - the more people who are able to see, admire and be inspired by the art, the greater the cultural value it accrues to its cryptographically-proven owner

You can find and DM me on Twitter (@0xPrismatic). I love getting your feedback.

Subscribe to The Metadata for the most informative and entertaining daily newsletter on NFTs, gaming, and the metaverse.

Due to blockchain, I don't think right-click will work. Easily verified by insiders