Solana vs Ethereum

Solana is our best bet to get to crypto's chatGPT moment

I’ve been mulling over the Ethereum vs Solana debate, a hot topic in the cryptosphere. It never ends.

I believe Solana will probably become one of the most valuable human inventions in the future, alongside Ethereum and Bitcoin.

I’m not going to delve into the technical differences here —there are plenty of thorough analyses, such as Syncracy Capital’s Solana thesis which I highly recommend everyone to read.

Instead, I want to offer a more personal perspective on where our industry is heading.

We’re running out of time

Crypto has been around for 10+ years. It has attracted hundreds of billions in capital from investors. And it has become a magnet for the brightest minds out there. We probably have one of the greatest concentrations of human talent in any industry (perhaps other than AI).

And yet, we haven’t found that elusive killer use case — one that the everyday person will feel severe pain if it were taken away from them. And which will make it impossible for governments to shut crypto down.

We desperately need a “chatGPT moment” for crypto. chatGPT is the fastest app ever to reach 100M users. It took just 2 months.

As the clock ticks, the pressure mounts. While there's currently some political and social support for crypto, these sentiments will wane over time if nothing impactful comes out of it.

We're standing at a crossroads, with the next few years poised to determine whether crypto will emerge as a pivotal, world-changing technology…. or be pigeonholed into just a few niche use cases.

We can’t afford to wait. The time has to be now.

For us to reach that killer app, the infrastructure layer must be able to support it.

The Tale of Two Philosophies

Ethereum and Solana are tackling the blockchain space with two different philosophies. But with the same end state in mind.

Solana’s philosophy is to first create a useful blockchain and then achieve decentralization and censorship resistance over time. It was designed for high performance and to be the best execution layer out there.

Low fees, low latency, and high throughput

Solana optimizes for atomic composability, believing that this is the most useful trait for blockchains.

UX is an improvement over EVM (e.g. no token approvals are needed)

Solana scales as hardware scales. And Moore’s law has held true for several decades.

It has been battle-tested for 3 years, with tooling and partnerships in place, unlike newer high-throughput systems like Sei.

Toly outlines his vision succinctly here:

On the other hand, Ethereum’s philosophy is to build a decentralized and censorship-resistant blockchain first and then improve its usability over time.

Its future development plans (Surge, Verge, Purge, Splurge) are centred on improving its scalability. This journey will unfold progressively over several years, not immediately. Today, transaction costs are high, and throughput is low.

ETH carries a significant monetary premium today to justify its almost $300B valuation, which cannot be explained by fees/revenue alone. This means a significant group of people view it as money. It is used as a:

Unit-of-Account & Means of exchange (many tokens and NFTs are denominated in ETH and traded in ETH),

Store-of-value

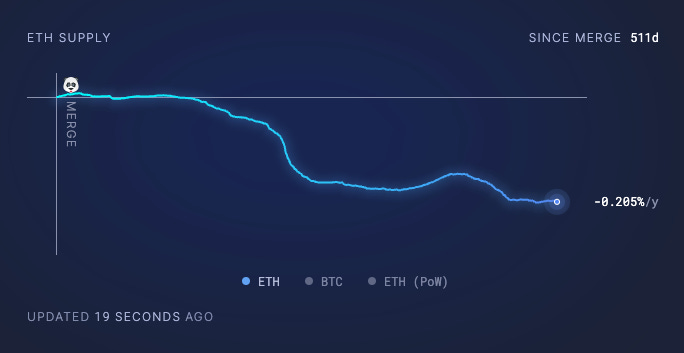

and has been deflationary for over a year

all of the above are key properties of money.

The well-accepted blockchain trilemma states that it's exceedingly difficult to achieve optimal scalability, security, and decentralization all at once in a single blockchain. This model suggests that focusing on improving any two of these areas often comes at the detriment of the third.

There's no perfect blockchain. Tradeoffs are necessary.

Much of the discourse surrounding Solana and Ethereum revolves around the compromises inherent in their designs. The key question is how these trade-offs are balanced—whether scalability comes at the expense of decentralization or if security should take precedence even if it impacts performance and fees.

Solana has faced concerns regarding its security and stability, particularly due to the absence of a major hack thus far and the limited scrutiny of its smart contracts, many of which are closed-sourced. Given the inherent risks associated with software development and code, it only seems like a matter of time before security issues arise. And this week the entire chain halted, the 11th time in its history.

Still, Solana may have reached a level of security and decentralization where scalability becomes the primary focus, and most important metric to optimize for to make the chain as usable as possible. We shall see.

The Big Question

I’m still figuring this out: What exactly do builders, entrepreneurs, and society want from blockchain technology collectively?

Consider this: Decentralization isn't an all-or-nothing concept but rather a spectrum.

Some use cases require more decentralization, while others do not. Money and finance: yes, I need reassurance that I control my assets and no single entity can take them away from me. Otherwise, I would just use a bank instead. But a game? Social media? These don’t need to be fully decentralized to be a step-up improvement over existing platforms by enabling greater user ownership and aligning incentives.

With this in mind, here’s my current mental model for the future of blockchains:

Power laws apply. A few (<5) general-purpose chains will capture the majority of mindshare

Multiple chains will exist, many with specialized use cases. App-specific chains will be ubiquitous

No one-size-fits-all solution

Both Ethereum and Solana will coexist. They will both likely thrive and become huge technological platforms. But I find myself leaning towards Solana’s philosophy, even though it has its flaws: less censorship resistance, urgent need for fee markets, light clients, etc.

Because Solana is today ready to support huge consumer-facing applications—compressed NFTs, for example—they are only available on Solana.

We need to find the chatGPT moment for crypto. Soon. Not in another 5 - 10 years.

And Solana could be our best bet to get there.

Other thoughts on blockchains:

Will we reach a point where users are chain-agnostic, meaning they no longer need to consider which blockchain a particular app is on? In this scenario, all backend processes are handled seamlessly, eliminating the need for users to worry about blockchain compatibility.

Such a future will introduce fragmentation and diminish network effects, challenging the power law dynamics observed with the EVM ecosystem which captures most developer mindshare and users today. There is some value in composability and for certain types of projects being together on the same chain.

Polynya states that most Web3 applications don’t need strict global consensus that public blockchains afford. It only makes sense for objective money & identity, because of the tradeoffs involved. Everything else can be done using off-chain methods.

On-chain money+identity. Off-chain everything else.

I tend to agree.

Cheers,

Teng Yan

"urgent need for fee markets". Solana has fee markets though, am i wrong?