The NFT Liquidity Trap

Liquidity conditions for NFTs today are highly exceptional. There ain't no free lunch.

Time flies. We’re coming to the end of Q1 2023.

If you haven’t had time to keep up with NFTs — don’t worry I got you.

I’ll distill down the main things that happened in February, the trends I’m most excited about, and my thoughts on the BLUR token launch. There’s a huge marketplace battle that is raging on right now.

1. More museums are starting to embrace and exhibit NFTs.

This is a significant trend that too few people are paying attention to. In February alone, two museums made their announcements. While these are not MoMA-s or TATEs, they make a difference.

Centre Pompidou houses Europe's most extensive collection of modern & contemporary art, with >1.5M visitors yearly. It announced a permanent NFT exhibition that includes CryptoPunks, Autoglyphs, and artworks by several French artists.

Los Angeles County Museum of Art (LACMA), the largest art museum in western US, received a gift of 22 NFT artworks by Cozomo de’ Medici. These include CryptoPunks, Dmitri Cherniak’s Ringers, and AI artworks by Claire Silver and Pindar Van Arman.

The traditional art world has been slow to adopt and accept NFTs, partly due to the fact that many traditional art collectors are older, wealthy individuals who are not as familiar with new technologies. A mindset change is in progress but takes time. Centre Pompidou's adoption of NFT art is just the beginning of a new trend in museums collecting and exhibiting NFT art. Although museums may be hesitant to be the first to do so, they will likely follow in the footsteps of these trailblazers once they see its success. As more NFT artworks are exhibited in physical exhibitions, their cultural value will increase.

Bullish on CryptoPunks & Chromie Squiggles.

2. Professional Gamer Mongraal wins Dookey Dash Key and sells it for $1.6M

As I outlined in my previous post, there’s been a shift from luck-based mints to skill-based mints. Did we really not expect a professional gamer (Mongraal in this case) to win the top spot in this skill-based mint by Yuga Labs?

What’s eye-popping, though is the prize: 1,000 ETH ($1,600,000)

That’s more than the total prize money Mongraal won in his entire Fortnite career of 77 tournaments. While this is probably an exceptional case, this will surely draw more professional gamers' interest into NFTs. And professional gamers bring along with them their audiences (Mongraal has 2M+ Twitter followers).

Overall, a positive for Web3 gaming, in my opinion.

3. Spotify & Reddit Make Headaway In Web3

On Web 2 to Web 3 integrations, these two things caught my eye:

Spotify is rolling out its token-gated playlist feature. This allows members to access an exclusive playlist if they hold certain NFTs. Two of the partners for the pilot include KINGSHIP (a virtual band under Universal Music) and Overlord (partnering with Seth Green)

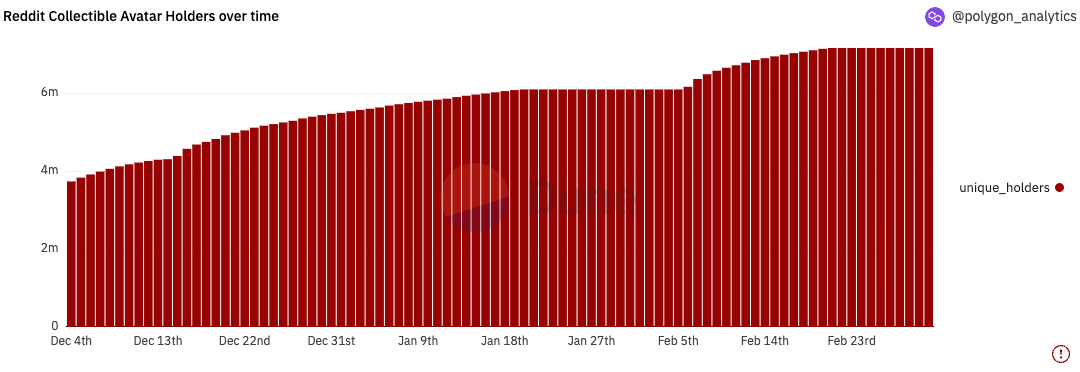

Reddit partnered with NFL to launch its Super Bowl LVII Collectible Avatars in February. Within a few weeks, >1 million Super Bowl NFT avatars were created. This brings the total number of Reddit Avatars minted to over 10 million, with 6 million unique holders.

Now, most of the people who claimed the avatars probably had no idea they were NFTs, so it’s a bit of a misleading statistic. But a victory to celebrate nonetheless. What’s important is how Reddit leverages the blockchain to create unique experiences for their Avatar holders in the coming months. I can think of many cool ways: rewarding loyal users with additional benefits, unlocking access to certain subreddits, etc.

Last but not least: Is Blur a Liquidity Trap?

And the crème de la crème for February — the launch of the BLUR token, intensifying the fight between Blur and OpenSea. Over 110,000 recipients received the BLUR airdrop, a total value of $240M. The sheer amount of value created out of thin air sparked a frenzy of people farming for the next BLUR token airdrop by placing bids (“bid farming”). There’s $140M worth of ETH in the Blur bidding pools today:

For some collections like Rektguys or Moonbirds, you can sell 30 - 40% of the total supply (3,000+ NFTs in a 10k collection) at close to the floor price while barely moving it. I don’t think you can do this with any fungible token today.

But let’s take a step back and think deeper: Liquidity conditions for NFTs today are highly exceptional. This is an anomaly. So don't expect this to last forever — the level of real demand in NFTs is still limited today.

The great economist Milton Friedman once said: “there ain’t no such thing as a free lunch.”

I believe the massive liquidity on Blur likely starts to taper off from here.

What some may not realize is that there is a cost to these exceptional liquidity conditions. Conceptually, BLUR tokens are paid out every single day to maintain these levels (even though distribution is at intervals)

Let's assume Blur Season 2 lasts for 6 months and distributes 300M tokens:

300M / 180 days = 1.66M tokens per day = $1.3M at today’s prices.

Essentially, the market has stated its price for providing NFT liquidity, the summation of everyone’s expectations of the risk-reward of Blur bid farming. The market is saying that you need to pay us $1.3M/day to maintain ~$130M in liquidity. That’s approximately 1%/day. Annualized that comes up to 365% APR. A very hefty fee by any standard.

(Note these are approximate calculations as Blur has not revealed the length of Season 2 yet. It could be more or less)

Now the good news (or bad, depending on how you view it):

Blur is “paying” for all of this liquidity with its token. It’s witchcraft: not a single cent comes out of their pocket, yet they have been able to use their token as a lever to overtake OpenSea in terms of trading volumes. All of this liquidity is subsidized by the people who are buying up the BLUR token on the secondary markets.

Yet, if Blur thinks that future value is going to accrue heavily to its token and that BLUR is going to be much more valuable in the future, it must be really painful giving it away so easily to mercenary capital. Giving away ownership is expensive. It’s a difficult conundrum.

A few other thoughts:

I think it’s smart of the Blur team to keep the next airdrop distribution under wraps without revealing too much. This is unlike many DeFi protocols where yield farming APRs are transparent. It passes additional risk onto the liquidity providers, who have to live with uncertainty.

The first major liquidity drop-off will likely be when the bonus 2X multiplier for bid/listing points ends on 1 April. There is real risk involved in BLUR farming. For farmers without sophisticated tools, the risk-reward will be no longer worth it.

If the BLUR token price bleeds down (as we get closer to investor unlocks, attention wanes, or just choppy market sentiment), the reward vs. risk ratio falls further. More liquidity will leave. Or a few whales just decide that they've farmed enough and pull their bids.

If you're a whale with 100s of NFTs of a particular collection, this could be a rare opportunity to offload without crashing the market. I’m not saying that you should. BUT if you were looking to do so, you have a small window of opportunity.

Side note: It’s pretty clear that Gem is going to be OpenSea's play for the pro-trading audience. Gem is getting ready for war, and its founder Vasa has been very active on Twitter after staying low for a while. Gem might launch a token (purely speculation). This allows OpenSea to continue its focus on casual collectors/retail and creator launch tools.

IMO the key takeaway is that Blur has shown us that the competitive moat for NFT marketplaces is a lot shallower than we think. Switching costs are low. Retaining users is hard: they go where the incentives are.

Has Blur achieved "Product-Market fit"? Probably, but let's be clear on what the "market" is. It's not the entire NFT market. It's a specific audience of pro traders and NFT whales. The long tail of users remains on OpenSea.

Lots of uncertainty ahead, but one thing is for sure. Blur will have to continually drive demand for their token in order for these levels of liquidity to persist. The token becomes another product to manage. Looking forward to seeing the next trick they pull from their hat.

Stay safe and best regards,

Teng Yan

You can find and DM me on Twitter (@0xPrismatic). I love getting your feedback.

i like your article