The Pot of Gold In NFT Finance

Is it all going to crash and burn, or is there a silver lining in the bear market?

In the first half of this year, I’ve spent a good amount of my time (research, working with startups) on two sectors within the NFT space:

(1) Art, including AI Art, because it’s one of the first use case of NFTs that’s achieved a reasonable product-market fit.

And (2), NFT Finance. I am of the firm belief that if you believe NFTs are going to become huge and you’re able to zoom out, it’s just obvious that this sector is poised for explosive growth.

The Current State of NFT Lending

This year, the NFT market has seen a contraction in daily trading volumes compared to earlier highs. From the high in August 2021 with nearly $2.8 billion in 30-day trading volume, NFT markets have settled at around $400 to $500 million in traded value per month. Of this, about 80% is for Ethereum-based NFTs, followed by 12% on Solana. The rest is split among Polygon and other blockchains (L1s & L2s)

But a friendly reminder: The NFT market is not going away.

The NFT Sector's Market Cap is projected to exceed $230 Billion — the current market cap of Ethereum — by 2030. My personal belief is that it will happen sooner than this. Despite financial instability, regulatory crackdown, devaluation of crypto assets, and the behavior by some participants in the centralized sector of the crypto industry, crypto assets are here to stay. Digital collectibles, entertainment & games are all huge markets where NFTs will play a pivotal role in.

We’re in a bit of a conundrum today, though.

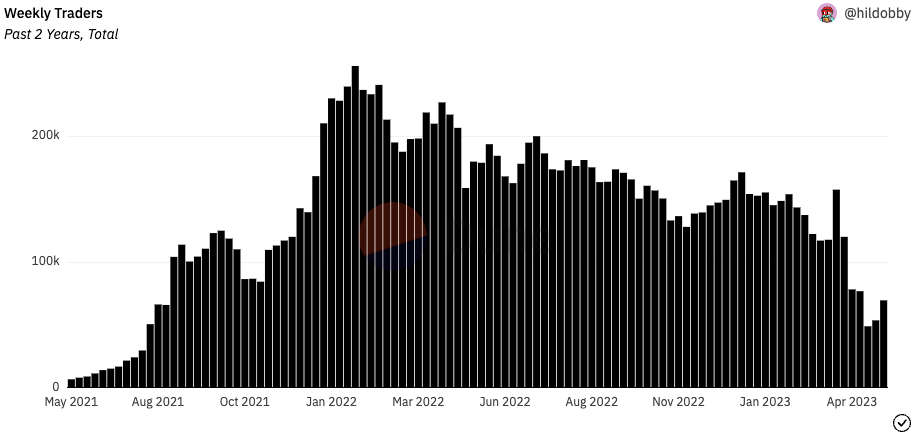

The Total Addressable Market (TAM) for NFT lending and financial tools is small and appears to be contracting. On Ethereum today, there are approximately 69,000 weekly NFT traders, a metric I use as a proxy for potential NFT lending users today. This is because users take out loans of NFTs typically either to leverage up (buy more NFTs they are bullish on) or as a price hedge, and are typically involved in some form of NFT trading activity. This number has dropped by 60% since January of this year, indicating a shrinking user base.

NFTfi, the largest NFT lending protocol on Ethereum, takes a 5% fee on loan interest. The monthly average loan size on NFTfi is $9,549 with an average APR of 25%. Extrapolating this and assuming the average user stays active for an equivalent of 1 average loan over 1 year before churning, we can estimate the average revenue per user (ARPU) to be $9,549 * 25% * 5% = ~$120

TAM = ARPU * Total Potential Users = $120 * 69,000 = $8.28M today

This is probably very conservative. For example, it’s not unreasonable for protocols to push fees closer to 15 - 20% when the market sentiment improves, or for users to start taking more loans when prices are rising. The exact TAM number is not the important thing here though. Rather, it just gives us a reality check of where we are today.

In the near term, I do not foresee any catalysts that could reverse this trend and significantly expand the market size. Unless there are major surprise developments, it seems unlikely that the TAM for NFT lending will grow substantially in the next 6 to 12 months.

The Silver Lining: Two Potential 'WIN' Scenarios

BUT… it’s not all doom and gloom. Despite the current challenges, I believe there are two potential 'WIN' scenarios that NFT finance founders should build towards:

The next retail-driven NFT bull market cycle

The conversion of real-world assets into NFTs

The Next NFT Bull Market Cycle

I’m pretty sure that another epic bull run involving NFTs is coming. It is just a matter of when. Speculation is an inherent feature of the crypto market, not a bug. This bull run will likely occur when we reach the next inflection point of innovation and interest.

What will the next bull run look like? It could involve the same NFTs from this cycle: Punks, Apes, Azukis, Penguins, Squiggles, and other animals. Or it could be an entirely new set of NFTs that we haven't seen yet. I’m betting it will probably be a mix of both.

The signs that the bull market is here will be clear:

Fast-rising trading volumes on platforms like OpenSea and Blur,

New project launches every day,

Spikes in NFT Google search interest

Mainstream media headlines about NFTs.

Unlike the previous NFT cycle, the next cycle will provide traders with an abundance of easy options to leverage and hedge NFTs, using lending protocols and futures. You can expect a lot of volatility and wild price movements. If I had to guess, I’d say this might happen within the next 2 years.

When the bull market arrives, fee switches will turn on, and revenues for NFT lending protocols will be higher than anything we've seen before. It's not difficult to imagine a growth trajectory similar to 2021 (at least relatively) because these protocols are starting from such a low base today. But remember, bull market-fueled growth is cyclical. When the speculative frenzy ends, we'll likely see another period of low activity, interest, and fees, just like what we're seeing now.

Real-World Assets as NFTs

The second scenario involves the conversion of real-world assets (RWAs) into NFTs. Imagine NFTs representing houses, buildings, bonds, commodities like gold, cars, and high-end fine art. In my opinion, this is the true end game for NFT finance.

The concept of tokenizing real-world assets (RWAs) as NFTs is not new, but it has gained significant traction in recent years. The idea is simple: convert the rights to an asset into a digital token on a blockchain. The NFT can then be bought, sold, or traded much like any other digital asset, but it has the added benefit of being backed by something tangible in the real world.

One of the main advantages of bringing RWAs on-chain is the ability to trustlessly take out a loan in minutes, instead of filling out numerous forms and waiting weeks for approval in the traditional world.

RWAs, as represented by NFTs, will likely be traded less often than speculative digital assets (e.g., Bored Ape Yacht Club). However, they function as excellent loan collateral because they already have proven value and real demand in the broader world.

The demand for lending and financial tools for on-chain, real-world assets is less cyclical compared to bull runs. This will result in a significant baseline demand for NFT finance and loans.

There are a few proofs-of-concept for RWAs today. For instance, Roofstock (@rsonchain) has already sold three 'NFT' houses for between $175,000 - $218,000 each. Each NFT represents sole ownership of an LLC tied to the home.

However, there are still many hurdles to overcome before we reach this 'WIN' scenario. These include establishing legal frameworks for tying ownership to NFTs, building infrastructure to enable this to happen frictionlessly, fostering a mindset shift and institutional adoption, and navigating a less hostile regulatory environment.

My intuitive guess is that we could see meaningful use of NFTs to represent real-world assets in about 4 - 5 years (2027+),

So What To Do?

If you're building in the NFT lending/finance space, here are three things I would advise:

Survive: The first priority is to stay alive for the next 3 - 5 years. This is the estimated time frame within which the above theses might play out.

Keep Building: Continue to improve your core product. The market may be small now, but it's important to be ready when it expands.

Avoid Zero-Sum Tactics: Aggressive, zero-sum competitive business tactics are probably not needed today. The market isn't large enough to warrant such strategies.

The worst thing that can happen is to burn out or fade into irrelevance before these two 'WIN' scenarios play out. What's happening today will be just child's play compared to the possible ‘WIN’ outcomes ahead.

The journey of NFT finance is just beginning. The challenges are real, but so are the opportunities. I have the deepest respect for everyone building in the space. Let's shape the future together! Feel free to DM me on Twitter to chat.

Thank you for your great article.

How do you think about Game Asset NFTs? I assume they will become one of the important use cases and its TAM will be large in few years

Great article and great insight into what's next for NFT, I already sent you a private message on Twitter.