November NFT Highlights, Spotify & Creator Royalties

Also: Uniswap Launches its NFT Aggregator

Hello friends 👋,

In this post, I pen down my quick and dirty thoughts (*chuckle*) on two to three interesting headlines or ideas. I write so I can think better. Hopefully, it might be helpful to you.

Let’s get to it.

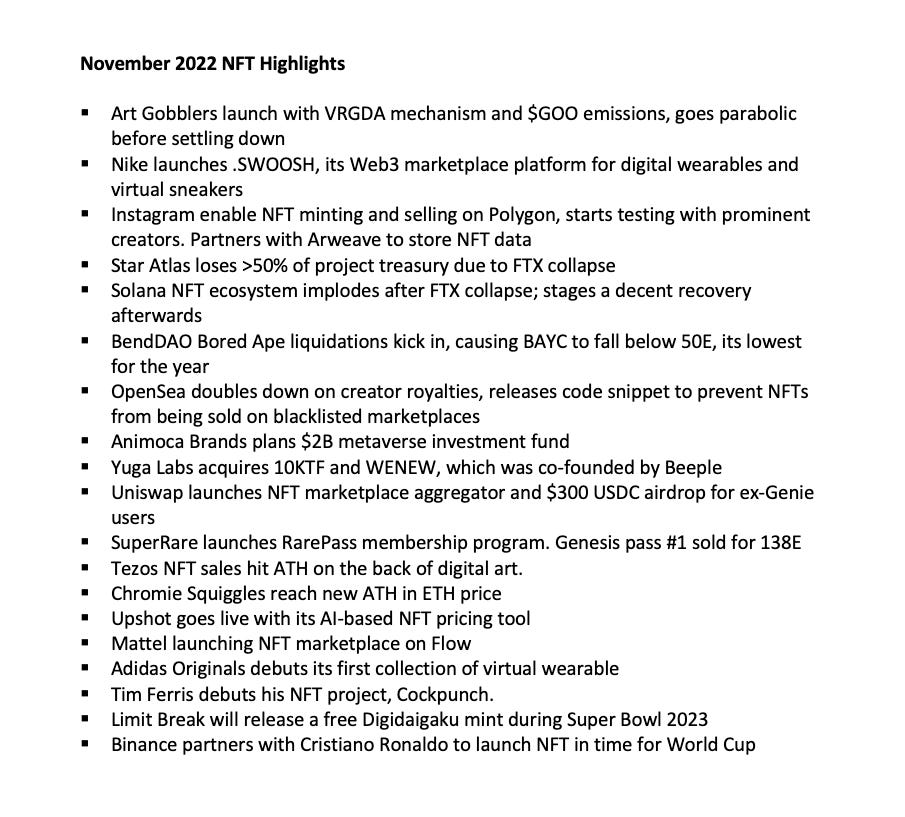

1. November 2022 NFT Highlights

November was a fascinating month for NFTs. Despite the FTX collapse and people toiling that “crypto is dead”, there were many new developments. Most notably, Nike and Instagram released concrete announcements about their NFT plans, sending a positive signal that reverberated throughout the space.

There was significant price volatility in November, with Bored Apes hitting their lows for the year and top Solana NFTs (e.g., DeGods) collapsing after the FTX bankruptcy. Yet, they have both staged a significant recovery in the aftermath. It almost feels like NFTs are living in their own little bubble, shielded from the carnage in the rest of the crypto space.

Putting this together reminds me that there is so much passion and activity in the sector and that prices don’t necessarily reflect that.

2. Uniswap’s NFT marketplace aggregator: Hit or miss?

Now you can buy your favorite NFTs directly from the Uniswap interface….hooray? It aggregates listings from 7 major marketplaces (OpenSea, LooksRare, X2Y2, SudoSwap, Larva Labs, Foundation, NFT20 & NFTX).

Marketplace aggregation in Web3 is very powerful and scalable because of the composability & provenance on-chain. The core idea is that more listings will lead to more transactions and better prices. It is also a hyper-competitive space with few moats.

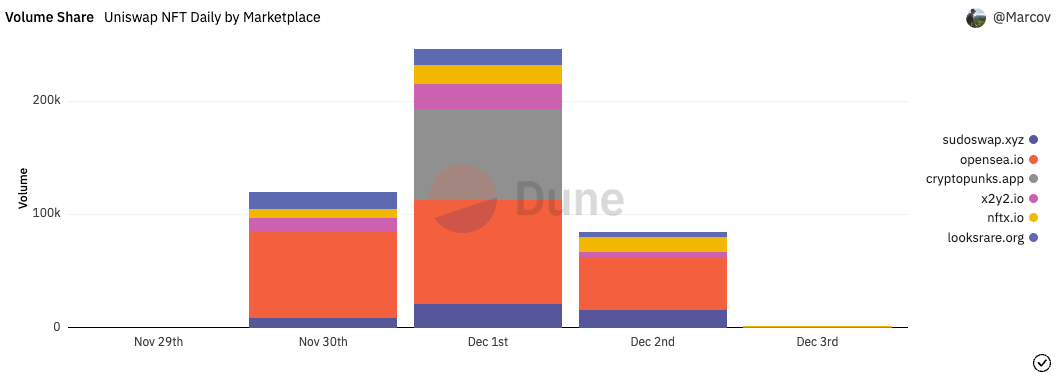

Quick stats in the three days since its launch:

$450,000 in Gross Merchandise Value (GMV) passed through Uniswap. Most of it was directed towards OpenSea (~50%)

842 total buyers

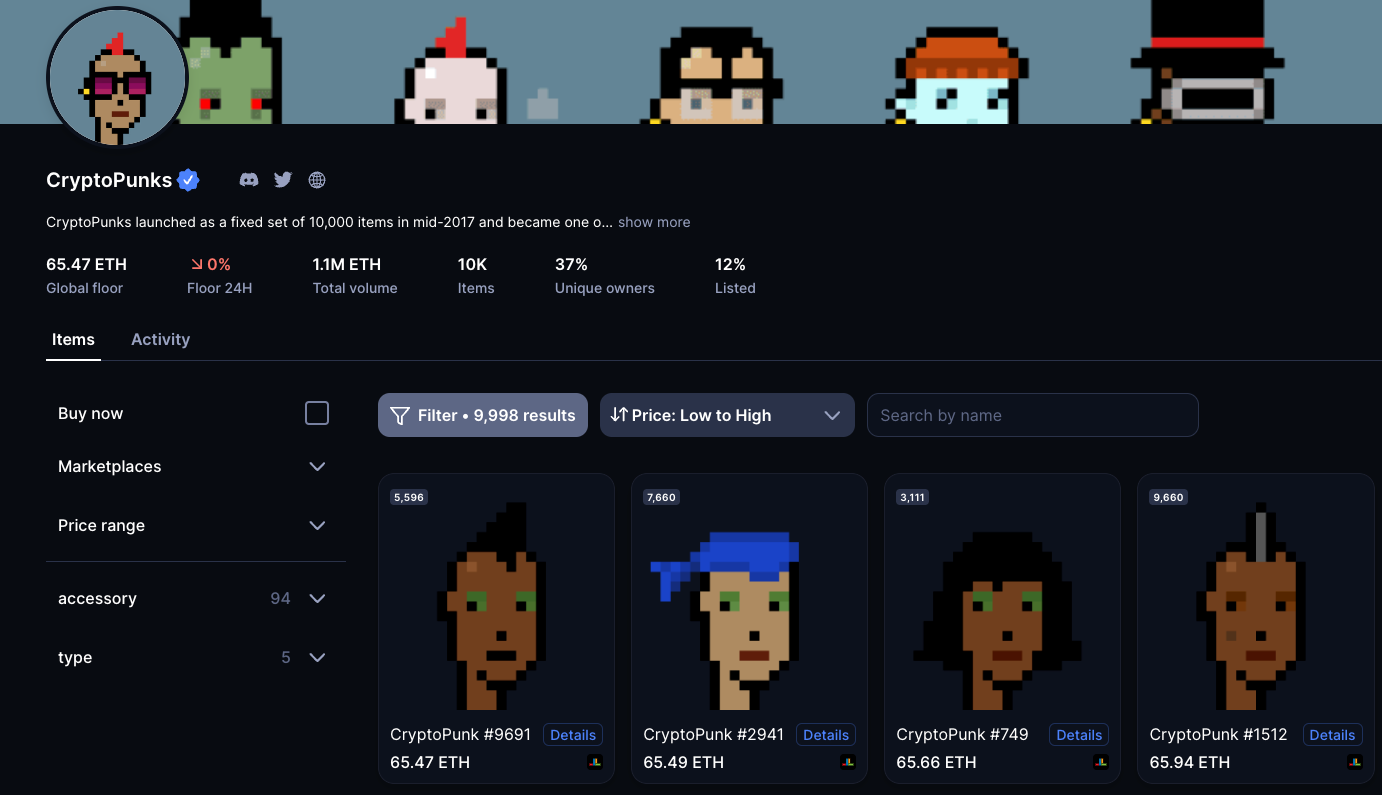

CryptoPunks and Pudgy Penguins are the top-traded collections.

If you tried trading NFTs on Uniswap, you'll realize its feature set is basic and not unique. In fact, it is inferior to more established products like Gem & Blur. It lacks detailed search functions as well as collection-specific analytics. Interestingly, Blur is not included in Uniswap’s aggregation list — and it is also its biggest competitor. Let the battle begin!

Uniswap claims its gas fees are 15% cheaper compared to other NFT aggregators and is offering gas rebates for the 1st 22,000 users. IMHO, this is not big enough of a hook to get most users to switch away from their favorite aggregator. Especially in today's low gas fee environment.

The $300 USDC airdrop for ex-Genie users feels like a missed opportunity. Many people (myself included) claimed the airdrop and walked away. $5M was spent on the airdrop, with little to show for it. I would have loved to see Uniswap make users perform certain activation tasks on the platform to claim the airdrop — such as listing, selling, or buying NFTs. This pushes users further down the conversion funnel, from Awareness to Retention.

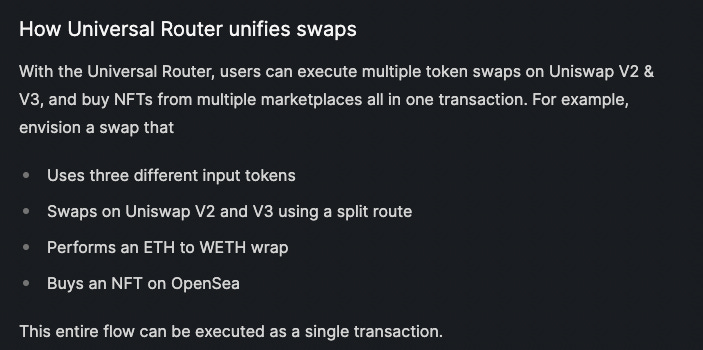

Despite its flaws, what piqued my interest the most is the new Universal Router that enables complex swaps involving ERC-20s and NFTs to be executed as a single transaction. You can purchase NFTs from different marketplaces with one click. This is a step up in user experience & efficiency, especially if these types of transactions become more common.

Uniswap has 2,000,000+ unique users this year and ~200,000+ MAUs. Could some of these users be red-pilled into NFTs, now that it is more convenient than ever? Possible. There's not a huge overlap between DeFi and NFT users today.

Uniswap is betting on the growing convergence and synergy between fungible and non-fungible tokens in the future. It’s bringing its impeccable brand name to the table, positioning itself as the premier bridge between these two ecosystems. With a huge war chest (having raised $165M in October), Uniswap can afford to be patient and play the long game.

With Uniswap's entry, NFT users are the main winners. And that’s good. Just like Uber vs. Lyft: more competition = better products + lower prices.

3. On Spotify and Creator Royalties

Over the weekend, I watched the Netflix mini-series “The Playlist”, which is the dramatized story of how Spotify came to disrupt the music industry. It’s an entertaining and informative watch for anyone in tech and highlights perspectives from various stakeholders in the music industry (thanks Santiago for the recommendation).

Very simplistically, the traditional business model in the music industry (Sony, Warner, Universal) in the early 2000s was:

Produce good music → Sell music (CDs) to users. Sell licenses to organizations.

As the world became more digital and streaming became a real thing, Spotify and its predecessors (e.g., Pirate Bay) came in to disrupt the music industry with new business models. It looks something like this:

Make music free → Greater audience reach → Earn from merchandise, ticket sales, ad revenue, premium subscriptions

The fundamental question in the new business models was: how do you pay artists for their work? Artists have usually been the ones with the least leverage in the industry and are often on the losing end.

It made me think that similar parallels are happening with NFTs and royalties today.

(Most) users have signaled that they don’t want to pay royalties or marketplace fees, especially when there is zero incentive. NFT trades with royalties on Magic Eden dropped to 10% once optional royalties were implemented.

Users will find ways to avoid royalties — and there will always be ways because royalties are not enforceable on-chain (without significant centralization tradeoffs). OpenSea and Magic Eden’s recent royalty protection tools are like using sticky tape to plug holes in a sinking ship. I appreciate their efforts, and it is a worthy fight to be in. But it feels like the odds are heavily stacked.

Similar to music lovers downloading their favorite artists’ MP3s for free on The Pirate Bay, I can feel a zero-fee movement brewing in NFTs that is difficult to stop. I’m a huge supporter of artists getting paid, and I truly believe artists should be paid way more for bringing their creative works to the world. I love the idea of creator royalties.

Yet, there will probably be a paradigm change in the business models for Web3 creators. We need to think out-of-the-box, beyond royalties. Similar to what Spotify did for music, someone will disrupt this.

You can find and DM me on Twitter (@0xPrismatic). I love getting your feedback.

Subscribe to The Metadata for the most informative and entertaining daily newsletter on NFTs, gaming, and the metaverse.