What's Next for PFPs?

Now that the speculative mania has subsided, where do Bored Apes, Doodles, Azukis and other PFPs go from here?

Hey all, sorry I’ve been away for a while. I’ve been meaning to get back into writing on substack, but the heavy lifting need to write a post always weighed on me. Instead, I’ll write shorter posts that cover some of my unfiltered thoughts on NFTs, metaverse & crypto. I aim to post at least once a month. Thank you for being here.

PFPs are down bad right now. Once the darlings of the NFT space, they’ve taken a massive hit in recent months. A Bored Ape was once worth $400K at its peak; today, it’s $100K. And it’s for good reason. The dopamine-inducing speculative fervor has died off, so PFPs have struggled to find their proper place in the world.

No one expected them to explode the way they did last year. PFPs (profile pictures) are our digital identities tied to us via an NFT. More than just a picture, they are also tokenized representations of community, culture, and social membership. At least, that was what we thought.

Now that our rose-tinted glasses have been put away, we have to figure out: what’s next? What do we do with these ugly pictures of a monkey?

All PFPs need to think hard about the following three things to survive.

1. How do you bridge out of Web3 into the real world?

Today, most PFPs are akin to exclusive country clubs. The cost of entry? 7E or whatever the floor price is today. Country clubs bring together like-minded individuals in social-friendly settings. A country club membership entitles you to certain perks, such as free use of facilities, invites to exclusive events, and voting on major decisions.

And that’s cool. As a ‘country club,’ PFPs can do lots of fun stuff for their members. Free hoodies, fanny packs, bomber jackets, and limited edition merchandise — everyone likes free stuff. In the web3 world, geeks and degenerates are now the cool kids and get to shape their clubs the way they like.

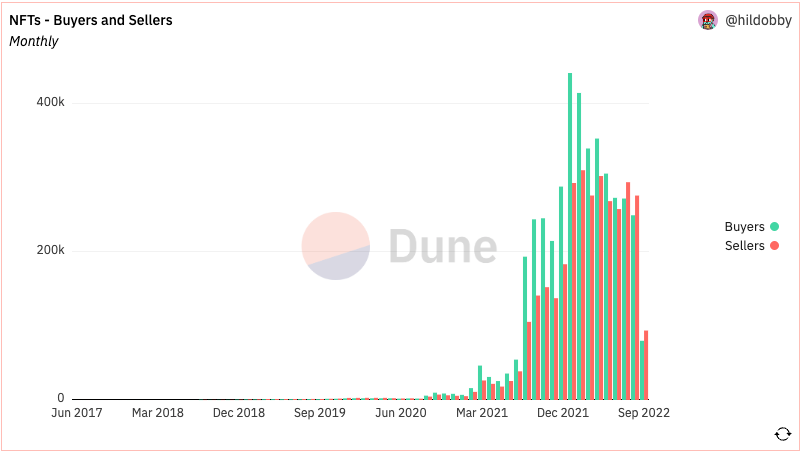

But as an exclusive ‘country club,’ you’re always going to be stuck in the echo chamber of your own importance. The hard truth is that the web3-native audience is small and niche. Ask any of your normie friends whether they’ve heard of Doodles, Azuki, or Clone X. The answer is no, almost every time. There are probably <300,000 people active in NFTs today, based on the number of buying wallets. Likely less, since many people use multiple wallets.

Today, PFPs are culturally insignificant in this world. They could disappear entirely tomorrow, and the rest of the world would not shed a tear.

If PFPs want to be culturally significant, they have to go out there and create culture. The culture that the world wants to lap up. Get into people’s minds, where they spend their attention on:

TV

Movies

Pop music

Fashion

Gaming

Entertainment/YouTube/TikTok

Each of these verticals is highly competitive and littered with the bodies of failed companies. Building robust and defensible IP is not easy. Success takes a magical confluence of luck, timing, money, deep expertise, and hard work. I balk when I see teams launching an NFT collection with a vision to produce a movie, anime, or game but have no team members with deep expertise & experience in the industry.

PFPs have one thing non-web3 companies do not have: the tools (NFTs) to nurture a highly engaged, loyal fan base that will co-create and co-evangelize with you. They can to use that superpower and tap on their communities to bridge the chasm into sustained mainstream awareness.

2. How do you build sustainable sources of revenue?

PFPs like Azuki, Clone X, Doodles, Cool Cats, Moonbirds, and Bored Apes made bank with >$10M in royalties earned in the past year. This was pure profit with 0 cost of goods sold (COGS). They were lucky — they were in the right place at the right time.

However, NFT trading volumes have fallen off a cliff since Q2 of this year. This also means royalties have slowed to a trickle since they are a direct function of the trading volume. Given the macro headwinds for global markets, it is also unlikely that we’ll return to the good ol’ days of super high royalties in the near future.

For the class of 2021/early-2022 PFP teams, I prefer to think of their past royalty earnings as a fundraising event for their treasury rather than representing a true source of recurring revenue ahead. Even worse: creator royalties are on a race to 0, with marketplaces like X2Y2 already making royalties optional to increase buying demand.

PFP teams have to go out there and hustle, finding new sources of sustainable revenue like any other startup. They can no longer wait for royalty money to come in. Some possible business models I’ve been thinking of include:

Licensing of IP / artwork to small & big brands. e.g. Uniqlo hoodies

Creating new product lines. e.g., merchandise and consumer products (Bored Apes coffee, anyone?)

Sale of digital collectibles that have some utility, akin to skins for Fornite/League of Legends.

Content & Media production house

Subscription services

But really, the sky’s the limit. We will soon see which teams have the business savvy and hunger to grow from a humble JPEG collection into a real tech + culture business.

3. How do you drive value back to your community?

Venture Capital is upping its NFT game. Moonbirds raised a $50M round in August, and Doodles raised a $54M round just this week (at a whopping $704M valuation). Clearly, some VCs like the JPEGs. And it’s good news for these PFPs. It gives them the fuel to go out there and expand their brands. Consumer companies need to burn an extraordinary amount of marketing dollars to grow, otherwise, they will be left in the dust.

It begs the question: Are NFT holders truly part-owners in the brand, or has everything we’ve espoused about community ownership just been a facade?

When VCs come in, the company’s priority for value accrual naturally shifts over to equity owners rather than NFT holders. After all, the investors paid a hefty sum for the equity and don’t own any NFTs. They need to get a 10X return on their investment.

The extreme case is that some PFPs become like traditional companies:

NFTs are used to raise seed capital, and that success is leveraged to raise further VC capital.

The idea of community ownership becomes a meme. NFT buyers are treated more like “customers” than “co-creators.”

More NFTs are sold to the community as they feverishly buy up the company’s next hyped NFT drop. The community becomes a source of revenue.

Community-driven initiatives — fan art, lore creation, IRL meetups — become akin to user-generated social media content. Creators spend hours producing fantastic content on Instagram: yet at the end of the day, all of the financial value goes back to the company, and creators don’t capture a single cent.

The NFTs eventually become just a digital collectible in the created universe, like a limited edition Luke Skywalker action figure (10,000 pieces only)

4156 summarises this succinctly in his tweet, I couldn’t have said it better:

I might be getting overly cynical here. The bottom line is that PFPs must recognize that their communities brought them to where they are in the first place. More people today have begun to understand that NFT owners have far fewer (legal) rights than they previously believed — we are still in the early days of figuring this out. Today’s regulations make it extremely difficult for NFT owners to also become equity holders and share in the profits. But at some point, I believe the gap will be bridged, at least somewhat.

Meanwhile, there is a social contract between the founders and the community. This means the team needs to continually find ways to deliver value back to the community in an authentic way. Otherwise, the trust is lost. It’s a slippery slope.

Whether PFPs teams embrace the ethos of web3 and community co-creation/ownership or go down the traditional startup-equity-VC fundraising path, it’s a philosophical decision. To me, the real magic happens in the former.

You can find and DM me on Twitter (@0xPrismatic). I love getting your feedback.

Subscribe to The Metadata for the most informative and entertaining daily newsletter on NFTs, gaming, and the metaverse.